The Investor's Playbook for Writers: How to Balance Your Medium Story Portfolio

What I learned from treating my Medium stories like an investment portfolio

You’ve poured countless hours into crafting your stories.

Each one is an investment — a piece of your portfolio.

But have you ever stopped to analyze how your portfolio is performing?

Do you know which of your stories is thriving and which is just sitting there, gathering dust?

Think of your stories as assets.

Like any good investor, you must know where to focus your time and energy to maximize your long-term returns.

Thinking Like an Investor

Warren Buffett didn’t amass his $135 billion fortune by chasing the next hot stock. He built his empire by investing in valuable, enduring assets.

Your stories might not make you a billionaire, but they can certainly earn you more if you apply some of the same principles.

Let’s dive into your portfolio and see how it stacks up using two key metrics you can pull straight from your Partner Program dashboard.

Lifetime Earnings

Every story you publish earns revenue when Medium members engage with it. Medium calculates these earnings daily, adding up to the lifetime earnings of each story.

Think of this: if you own stock in a company, it might pay you dividends. Over time, a portfolio of dividend-paying stocks can provide a steady income stream.

Your stories can do the same. The ones that keep earning month after month are your golden geese.

Longevity

Next, look at how long your stories have generated revenue.

Some might be flash-in-the-pan successes, while others continue to bring in money months, even years after publication.

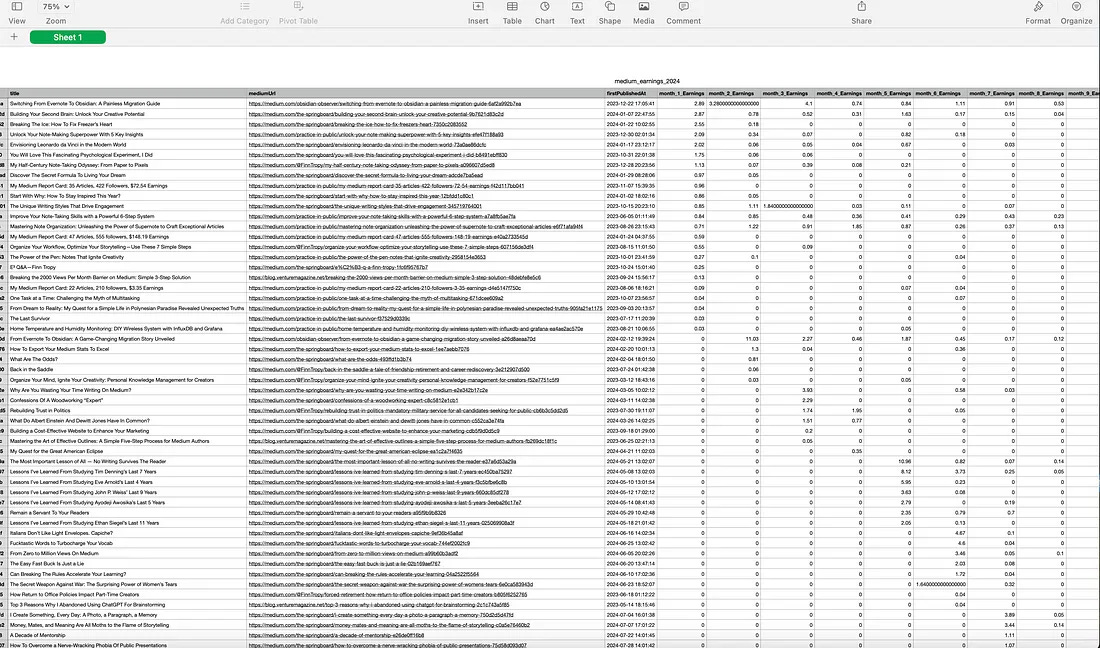

I’ve made this easier by creating a simple free tool that pulls your data into an Excel spreadsheet with a single click.

Trust me, it’s a lot easier to analyze your portfolio when it’s all laid out in front of you.

Analyzing Your Portfolio

In the stock market, you’ll find companies that soar during booms and others that provide steady returns no matter the economic climate. Every year, many failed companies file for bankruptcy.

A smart investor knows how to balance these different types of investments to match their risk tolerance and financial goals.

Your Medium stories are no different.

You need to know where your stories fall so you can make informed decisions about where to focus your writing efforts.

Here’s how I categorize my stories:

1. The Golden Goose - These stories are your heavy hitters — consistently generating high earnings over a long period. They’re your golden eggs, your most valuable assets.

2. The Shooting Star - These stories earn a lot quickly but don’t have staying power. They burn bright and fast, but they’re gone before you know it.

3. The Slow Burner - These stories might not bring in big bucks monthly, but they’re steady contributors. Like a slow-burning fire, they provide consistent warmth over time.

4. The One-Hit Wonder - These stories made a splash and then fizzled out. They had their moment but won’t sustain your portfolio in the long run.

My Portfolio Analysis

I’ve applied this approach to my stories and created a visual representation using a Python script that plots the CSV file from my stories on a four-quadrant graph.

The result? A clear picture of where my strengths lie — and where I might need to rethink my strategy.

In my case, I have way too many “One-hit Wonders,” so I had to remove most of them from the graph above to keep it readable.

I have a few “Golden Goose” stories. They have been earning money every month since I published them:

Improve Your Note-Taking Skills with a Powerful 6-Step System

Switching From Evernote To Obsidian: A Painless Migration Guide

My Top Authors Dashboard stories are mainly in the “Shooting Star” category:

Top Authors Dashboard - a set of 13 stories

I have quite a few “Slow Burners” in my portfolio. They provide a small but steady revenue stream.

Lessons Learned

I need to focus on re-balancing and improving my writing.

Listen for reader feedback and build a better understanding of my audience.

Provide practical tools and guides to my readers.

Help to solve problems and document the steps taken.

Work on my Finn’s Newsletter for another channel to distribute my stories.

Add more products like The Top Authors Dashboard on Gumroad

With these steps, I can improve my portfolio performance in the long term.

Ready to Build a Stronger Portfolio?

Now it’s your turn. Take a look at your stories through the lens of an investor.

Identify your golden geese, your slow burners, and, yes, even your one-hit wonders.

Each story is an opportunity to learn, refine, and grow your portfolio.

Invest in your success, one story at a time.

Want to get started? Grab my free tool to analyze your Medium stories in just one click.

Your writing deserves more than just effort — it deserves strategy.

Hey Finn 👋🏻,

Two questions I'd love to get your take on:

* What are effective strategies to keep past stories in play and earning?

* What about repurposing/rewriting/improving past stories and publishing updated versions with - hopefully - much improved writing, upgraded content, etc?

As a long term investor myself, I liked your post a lot.

Hi Finn, I just re-read this article Most other writeups about Medium say it's no longer worth the effort & a few weeks ago I canceled my partner program subscription (which admittedly I only had for a few months). Did I pull the pin too early? Is there still value in Medium? Not just the $$s, but the exposure value.